For the Tax payers, after paid TDS challan amount, have to check TDS challan status and verify it, so that we know, it is updated on our TAX details or not.

In this blog post, we are going to show, how to check TDS status online and verify it. This is very easy and straight forward process.

Steps to Check TDS Challan Status Online:

In this process, we have explained two ways to view TDS challan status. You can able to download TDS challan CSV file after verify it. Let’s check the step by step process:

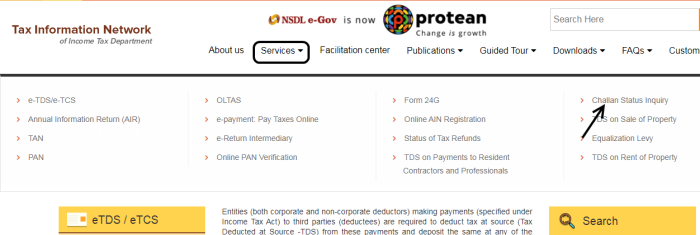

1) First you can google it with serach this query ‘TDS Payment’. Or you can directly open this link: https://www.tin-nsdl.com/services/etds-etcs/etds-index.html

2) Now look it for ‘Services’ menu tab and click ‘Challan Status Inquiry’ option link under it.

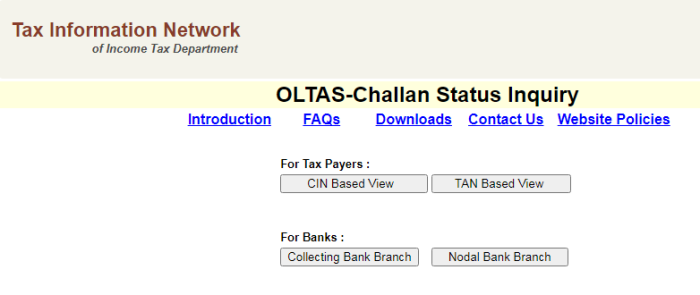

3) As you clicked, an OLTAS-Challan Status Inquiry page will display on your screen. Here you can verify your TDS challan in four ways and able to download CSV file.

You will need this CSV file, at the time of ITR filing. Throught this you can verify your TDS challan.

Note: If you are using any Accounting software to filing your ITR, then might be software verify your TDS challan automatically. Its depend upon the accounting software.

4) For TAX payers, two option given first is CIN Based View and second one is TAN Based View.

In CIN Based View, you can see your TDS challan status but not able to download TDS challan CSV file.

And if you go with TAN Based View then you can see the TDS challan details and also get the CSV file, which is reuired to at the time of ITR filing.

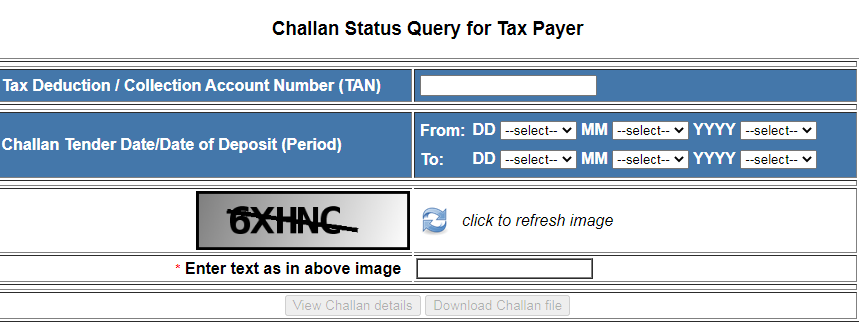

5) We shows you TAB based view method, For this you need to mention your valid TAN number.

Select challan deposit date, on which you pay your TDS challan. Fill the captcha code and click on ‘View Challan Details’ button.

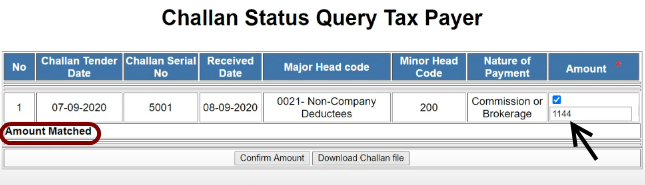

6) After this process, your TDS details will shows on screen. You will see challan tender date, serial number, tds recieved date etc.

Now to verify TDS challan, you have to enter your TDS paid amount under Amount column, and click on ‘Confirm Amount’ button.

If your entered amount is matched with the paid TDS record, then you will get ‘Amount Matched’ status below.

7) Now, you can download TDS challan CSV file copy with the help of given button option.

Also Read:

Change Name in PAN Card as per Aadhaar

Apply for Pan Card Online

In CIN Based view, you can see the TDS deductor name and some other details. For this you need to provide BSR number, TDS serial number, deposit date etc.