In this article, we are going to check the process to generate property tax no dues certificate in Haryana and how to pay for NDC online.

You can get NOC for property in haryana online via web portal of Directorate of Urban Local Bodies, Haryana (ulbhryndc.org). For this, you must be registered user in ULB portal.

If you don’t have account, then first register yourself on ulbhryndc.org website.

No Dues Certificate Covers Charges

The property tax no dues certificate states that there are no pending dues on the property concerned.

As such, it covers the following charges-

- Property or House tax

- Fire Tax

- Water supply and sewerage charges

- Solid Waste Charges

- Electricity bill

- Development charges

How to Generate Property Tax No Due Certificate & Make Payment

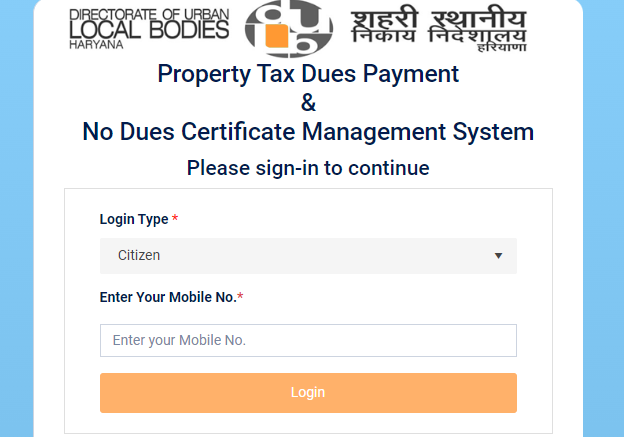

Step 1: Visit https://ulbhryndc.org website on your web browser. Choose your Login type as ‘Citizen’ and enter registered mobile number to complete login process.

Step 2: An 6 digit OTP number will send on your entered mobile number, verify it on web portal.

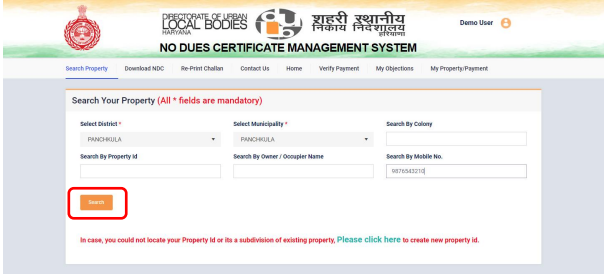

Step 3: After this you will see ‘Search Your Property’ form page. Here you can search your property details via choosing District, Municipality name.

Search your property via providing either colony name, property ID or by Mobile number. And hit the Search button.

Step 4: A list of properties data will shown on screen, Identify your property row and click on ‘Action’ button corresponding your property row.

Your property details will be display on screen.

Step 5: To make payment, click on Make Payment button at bottom side. It will again generate OTP number, just verify it.

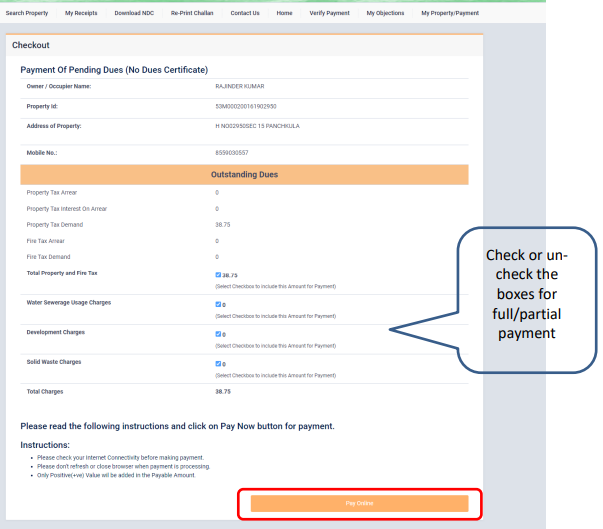

Step 6: Now, a page will open with all pending dues of your property related.

Its includes your property fire tax, water sewerage usage charges, development charges, solid waste charges details.

For partial payment, you can check or uncheck any given charge, total charges amount will calculate as per the selection.

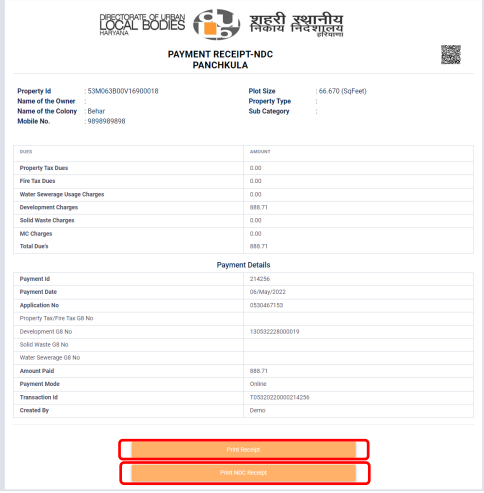

Step 7: To clear all pending dues, click on ‘Pay Online’. After successful online payment, the NDC along with payment receipt will generated.

Step 8: To print or view no dues certificate, click on ‘Print NDC Receipt’ button at bottom side.

Also Read:

Apply for HUDA Mortgage Permission

Apply Mudra Loan Online

By following above steps, you will able to download your property tax no due certificate online in Haryana.