Its mandatory that every property owner must pay his annual property tax to his area Municipal corporation or local gram panchayat authority. Gram Panchayat property tax can be paid via either offline or online mode. This tax applies on owner land, office building, intangible property etc.

Gram Panchayat Tax Payment Online Process

In this post, we guide you how to pay gram panchyat property tax online for different states. For demo purpose we shows step by step process for some areas.

To pay property tax, you have to visit official website of that perticular area or state. Let’s take a look of Maharashtra gram panchayat tax payment process.

Steps to Pay Gram Panchayat Property Tax Online in Maharashtra

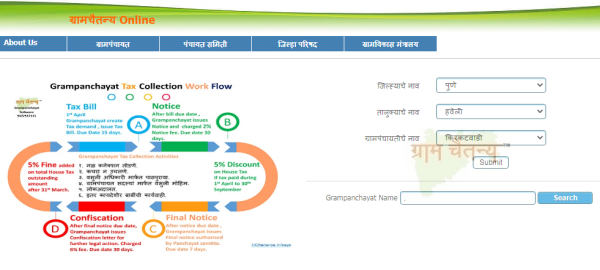

1) Open the Maharashtra gram panchayat official website: https://www.gramchaitanya.co.in

2) Now choose your District, block and gram panchayat name from the list and Submit it.

If you don’t found your panchayat name in given list, then you can also search for gram panchayat name.

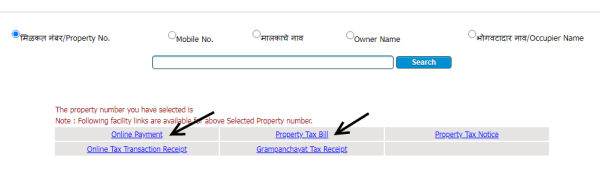

3) Enter your property number and search for it. Your details will shows on screen.

4) Now click on ‘Online Payment’ link as shown in below image.

Via this you can easily pay gram panchayat property tax online in Maharashtra.

Let’s check it another process to pay grampanchayat property tax in Karnataka state.

How to Pay Gram Panchayat Property Tax in Karnataka

1) Visit the official Bapuji Seva Kndra Karnataka website. Choose the website language as per your understanding.

2) To pay tax, click on ‘Property Tax’ option.

3) Enter your mobile number for OTP verification and tap on ‘Click here to pay tax’.

4) Now, enter your personal details like name, email id, mobile number etc. Choose your district, taluk and gram panchayat name from the list.

5) Then after search for your property details via 18 digit property ID number, which is mentioned in your e-Khata certificate.

6) After this, make online payment of tax and download property tax reciept.

Also Read:

Pay Road Tax Online

Apply E Shram Yogi Mandhan Pension

Procedure for Payment of Property Tax in West Bangal

1) Open the NKDA portal and click on “Assessment and Payment of Property Tax” under Quick Links section.

2) Now login on e-District with your User ID and Password.

Note: If you don’t have account in it, then you can register yourself as a citizen of state and get login access of it.

3) After login, choose Department -> NKDA -> Payment of Property tax.

4) Enter your assessment number and choose payment mode Online.

5) Fill all the required details and save it. After this make online payment and get the e-reciept of property tax.

Note: If you choose Offline mode, then take a printout of challan and pay the amount by visiting the authrize bank branch.

Gram Panchayat Websites of Other States:

Gram Panchayat Property Tax FAQs:

How can I check my gram panchayat online?

You can check your gram panchayat online via visiting official webportal of your Area or State

What is the formula of property tax calculation under gram panchayat?

Property tax = base value × built-up area × Age factor × type of building × category of use × floor factor.

Is gram panchayat property tax is exempted for senior citizens?

No, age is not a criteria for exemption

Do we have to pay property tax every year in India?

Yes, the tax must be paid every year.