Atal Pension Yojana Contribution Chart: Atal pension yojana is started to provide regular pension of Rs. 1000 to Rs. 5000 per month based on age and premium paid by beneficiaries. Till march 2022, approx 99 lakh accounts have been opened under this scheme.

To take benefits of Atal Pension Yojana, the applicant has to start invest in between of the age of 18 years to 40 years. Apart from this fixed monthly pension, financial benefit also provided to beneficiary’s family in case of untimely death.

Through this post, we will provide you information about how to open atal pension yojana account, its benefits and atal pension yojana contribution chart in detail.

Atal Pension Yojana Benefits

- This scheme specially designed for unorganized sector to provide financial benefits.

- If you enroll in atal scheme at the age of 18 then you have to pay a premium of rs. 210 every month upto age of 42 years. And if start at age of 40 years then have to pay premium of rs. 297 to rs. 1,457 per month upto age of 60 years.

- Like the PF account, central government will also contribute some amount on its behalf in this pension scheme.

- Only indian citizen can apply for atal pension scheme.

- Under Atal Pension Yojana, the amount of pension will be provided only on the basis of age and investment made by the beneficiaries.

- Monthly premium amount can be upgrade or downgraded based on beneficary choice.

- Enrolled person have a choice to pay premium monthly, quterly or half-yearly basis.

- You can get tax rebate under Section 80 CCD (1) of the Income Tax Act, 1961.

- In case of untimely death Atal Pension Yojana subscriber, the nominee would receive the opted amount under this scheme.

Atal Pension Yojana Contribution Chart

Let’s check out Atal Pension Yojana Chart details on the basis of entrly level age and monthly pension amount opted.

| Entry Level Age (years) | Total years of contribution | Monthly Pension of rs. 1000 | Monthly Pension of rs. 2000 | Monthly Pension of rs. 3000 | Monthly Pension of rs. 4000 | Monthly Pension of rs. 5000 |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 792 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

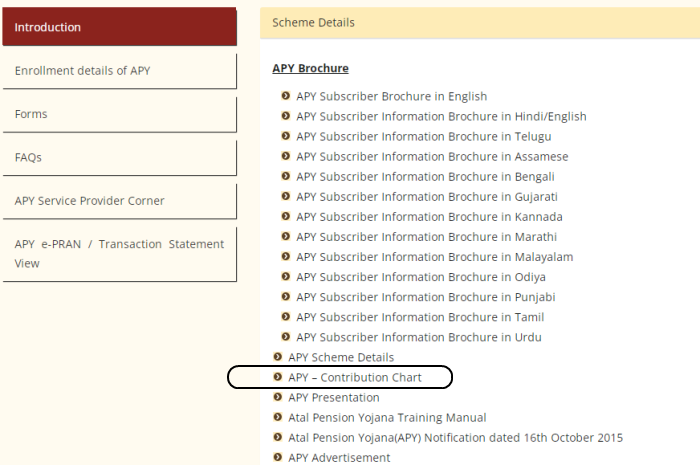

If you want to know about contribution amount on quaterly and half-yearly basis then you can check official atal pension yojana cart in pdf format on official portal: https://www.npscra.nsdl.co.in/scheme-details.php

On this page, click on ‘Contribution Chart’ link option, it will shows complete detail in pdf format.

Also Read:

Apply MP Old Age Pension

Haryana Old Age Pension

Life Certificate for Pensioners

How to Apply for Atal Pension Scheme

To apply for Atal pension yojana, first you have to download the APY application form and submit it at your local bank branch office.

Click here to get APY application form.

Fill the application form and also provide your bank account number, mobile number and Aadhar card number.

Your first premium amount will deducted from your linked bank account based on opted monthly pension amount.

An acknowledgement number (PRAN) is issue to you for reference.

Later subsequent montly premium will automatically deducted from your bank account.

Atal Pension Scheme Helpline Number

There is no centralised customer support number for Atal Pension Yojana. You can contact your nearest bank branch for APY account related issues

Alternatively, in case of Atal Pension Yojana Support you can call the following toll free numbers:

CRA (Central Recordkeeping Agency) – 1800-222-080

NPS Helpdesk – 1800-110-708